WEALTH MANAGEMENT & TAX STRATEGY

Do you feel the constant pull between growing your business, managing taxes, building diversified assets, and investing in your family today?

We’ll guide you with specialized strategies to manage cash flow, reduce taxes, and invest wisely so you can supercharge your wealth potential and make every moment count.

Entrepreneurial-Focused Strategies

Transform your hard work into lasting wealth through personalized strategies that fuel business growth, minimize taxes, and create a financial foundation that benefits your family for generations to come

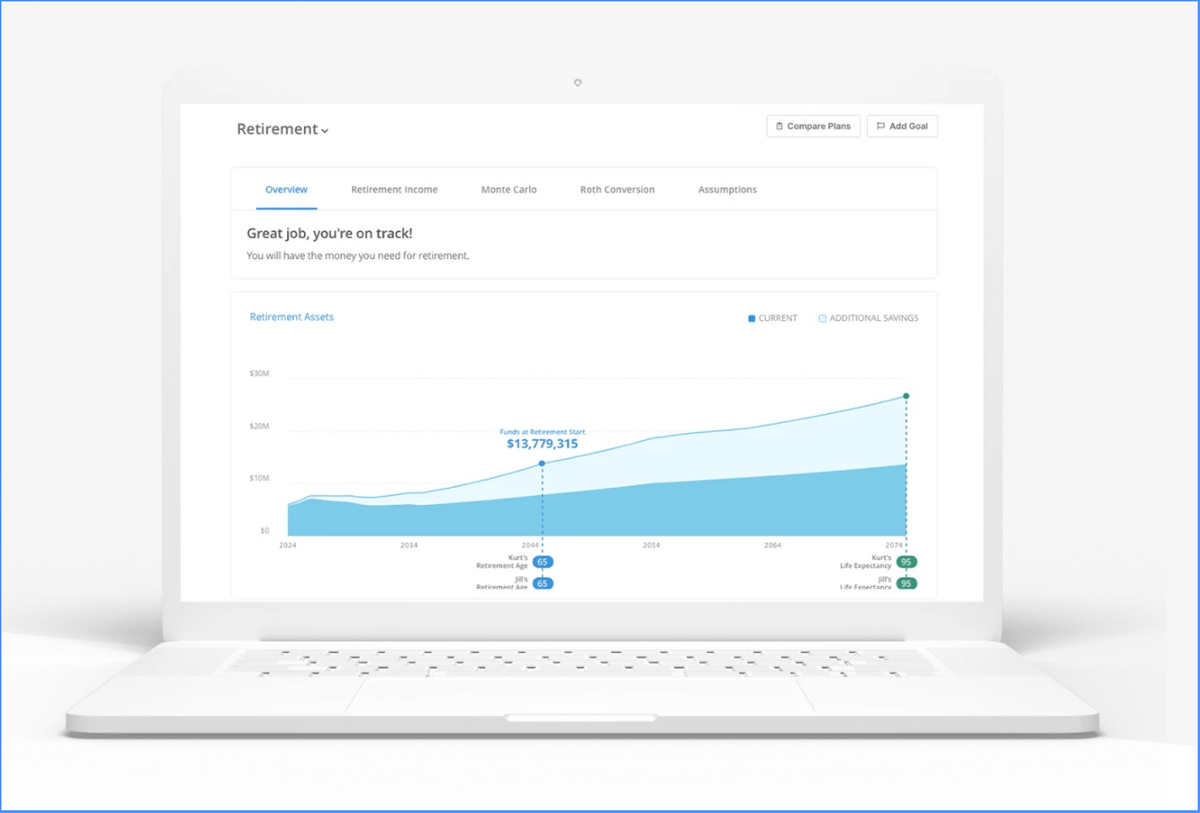

Milestones You Can See

Track your progress and see clearly what's possible in the future with a financial scorecard and one-stop view of your income and net worth over time, including business, real estate, and other investments

Investment Access Beyond "The Market"

Unlock a world of opportunities beyond cash, bonds, and public stocks to diversify your wealth and build a portfolio of enduring income, without sacrificing valuable time away from your business and family

FAMILY WEALTH FORMULA®

1. Family Wealth Strategy

- Discuss and prioritize your most pressing goals and concerns

- Explore your Peak Planning Index™ assessment to surface key planning areas

- Collaborate on the order and timing of planning modules to engage

2. Tax & Investment Strategy

- Build out your personalized Investment and Planning dashboards

- Dive into our tailored list of recommended ideas for tax savings

- Simulate your long-term wealth-building and income possibilities

3. Personalized Planning Modules

- Establish key automation and delegation

- Kick-off the Ridgeline Flywheel of Perpetual Planning

- Work through any remaining relevant planning modules at a pace that fits your life

4. Flywheel of Perpetual Planning

- Proactively prepare for near-term capital needs, tax mitigation approaches, and investment opportunities

- Receive ongoing guidance at critical milestones and key life events

- Rest easy knowing that our team cares for you every step of the way

Flywheel of Perpetual Planning

1Summits

We periodically prioritize time together to track progress to your goals, talk about new objectives, circumstances, and resources, review your investment strategy, run scenarios, and create meaningful action items.

2Huddles

Life happens, and we're here for you when you need guidance for key decisions or when plans change. Call us, email us, or schedule a time on our calendar for these as-needed planning and strategy sessions.

3Planning Ideas & Actions

We systematically analyze dozens of wealth-building and tax-saving ideas at key milestones throughout the year and then provide you simple, pertinent next steps at just the right time.

4Investment Due-Diligence

We continuously monitor and adjust your investments to remain on target for their purpose within your time frame, risk, and opportunity guidelines.

START PLANNING

RIDGELINE BASE CAMPS

ARIZONA, ILLINOIS, FLORIDA, and VIRTUALLY ANYWHERE

courtesy of cutting-edge, easy-to-use tech

THE TEAM

Caleb Huftalin, CFP®

DIRECTOR OF WEALTH MANAGEMENT

CERTIFIED FINANCIAL PLANNER™ with a mission to guide leaders to implement wise financial decisions that advance their vital purpose

Husband and dad (four boys!)

Lives at the base of the Superstition Mountains in the far east valley of Phoenix, AZ

Loves to adventure with family as they hike in the mountains, explore primitive roads, and travel anywhere

Steve Hofmann, JD, CPA, CFP®, PPC®

DIRECTOR OF WEALTH PLANNING

Attorney, Certified Public Accountant, CERTIFIED FINANCIAL PLANNER™ and Professional Plan Consultant® guiding leaders to align their decisions with their goals

Husband and dad (three girls and a boy!)

Lives in Northern Illinois 70 miles west of Chicago

Enjoys training for the next run, exploring the outdoors with family, and traveling to fun places

Brandon Catrett, CFP®

WEALTH ADVISOR

- Seasoned financial planning professional passionate about helping families align their finances with their goals and values

- Husband and Dad (A boy, a girl, and two dogs!)

- Lives in south Jacksonville

- Loves to be outdoors, on the water, or traveling to new places with family and friends

Josh Eberhard

FINANCIAL PLANNER

- Focus: Streamlining your financial journey with strategic planning, personalized strategies, and ongoing support.

- Husband (married to high school sweetheart)

- Lives in Phoenix, AZ

- Loves to hike, golf, and explore the great outdoors, creating unforgettable memories through family travels

Carron Schmick

DIRECT INVESTMENTS SPECIALIST

- Focus: Bringing 25+ years of public accounting, financial, and real estate experience to coordinate direct investment opportunities for clients, such as 1031 DSTs and Qualified Opportunity Zone Funds

- Wife and mother

- Splits time between Gilbert, AZ and Hawaii

- Loves to travel and enjoy hockey with an eye for anything unique, good tasting, or fun

Diane Pascua

CLIENT SERVICE MANAGER

Focus: Streamlining Ridgeline operational, portfolio management, and communication tool processes

Wife and Dog Mom; Buster and Willie

Lives in the Mesquite Canyon neighborhood in East Mesa, AZ

Loves to hike, read, teach Pilates, and adventure with her husband

FREQUENTLY ASKED QUESTIONS

Being based in Arizona, Illinois, and Florida can you work in other states?

Yes! Ridgeline is intentionally location-independent with advanced tech tools that allow us to easily work with anyone across the United States. We have clients from Florida to Alaska, California to Michigan, and numerous places in-between. You get a flexible, efficient working relationship with our team (and no sitting in traffic or a stuffy office). We use tools such as Zoom, Google Drive, SendSafely, and Front Scheduling.

Will you work with us even if we're not business owners?

We invest our time and effort in learning how to better serve current and former business owners and entrepreneurs, so those families benefit most from our planning expertise and methodologies. Still, our process leads to wise financial decisions for anyone who wants more time for family and adventure.

Are you a fiduciary?

Yes. We believe in placing our clients’ best interests first. Therefore, we commit to the following five fiduciary principles: 1) We will always put our clients’ best interests first. 2) We will act with prudence; that is, with the skill, care, diligence, and good judgment of a professional. 3) We will not mislead clients and will provide conspicuous, full and fair disclosure of all important facts. 4) We will avoid conflicts of interest. 5) We will fully disclose and fairly manage, in our clients’ favor, any unavoidable conflicts.

What is wealth management?

Wealth management is a form of investment management and financial planning that provides solutions to a wide array of clients. It incorporates financial planning, portfolio management and a number of aggregated financial services offered by investment banks, asset managers, custodial banks, retail banks, and financial planners. Business owners and families who desire the assistance of a credentialed financial advisory specialist call upon wealth managers to coordinate retail banking, estate planning, legal resources, tax professionals and investment management.

Investment advisory services offered through Ridgeline Private Wealth, a registered investment adviser. Investment adviser representatives of Ridgeline Private Wealth may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed until appropriate registration is obtained or an exemption from registration is determined. Not all services referenced on this site are available in every state and through every advisor listed. For additional information, please contact Caleb Huftalin at 480.779.0127. All written content on this site is for information purposes only. Opinions expressed herein are solely those of Ridgeline Private Wealth and our editorial staff. The information contained in this material has been derived from sources believed to be reliable, but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed. All information and ideas should be discussed in detail with your individual adviser prior to implementation. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Images and photographs are included for the sole purpose of visually enhancing the website. They should not be construed as an endorsement or testimonial from any of the persons in the photograph. The inclusion of any link is not an endorsement of any products or services by Ridgeline Private Wealth. All links have been provided only as a convenience. These include links to websites operated by other government agencies, nonprofit organizations and private businesses. When you use one of these links, you are no longer on this site and this Privacy Notice will not apply. When you link to another website, you are subject to the privacy of that new site. When you follow a link to one of these sites neither Ridgeline Private Wealth, nor any agency, officer, or employee of Ridgeline Private Wealth, warrants the accuracy, reliability or timeliness of any information published by these external sites, nor endorses any content, viewpoints, products, or services linked from these systems, and cannot be held liable for any losses caused by reliance on the accuracy, reliability or timeliness of their information. Portions of such information may be incorrect or not current. Any person or entity that relies on any information obtained from these systems does so at her or his own risk. Google uses a five-star rating scale to rank businesses based on performance. Business reviews are graded from one star (Poor Service) to five stars (Excellent Service). Google uses a proprietary algorithm to average the reviews together to determine an overall star rating. Google’s five-star rating is subjective and based on the Client’s experience. Client testimonials, statements, opinions, and/or likes herein were solicited and are non-representative of all Ridgeline Private Wealth clients; the Client testimonials, statements, opinions, and/or likes are representative of the Client’s experience, but the performance and experience will be unique and individual to each Client. Past performance is not indicative of future results, and investors may realize losses on these investments, including a loss of principal. The Client was not provided any form of monetary or non-monetary compensation for providing a testimonial regarding our services. © 2022-2024 ADV Part 3: Form CRS

2929 N Power Rd, Ste 101, Mesa, AZ 85215 /// 7210 E State St, Ste 102, Rockford, IL 61108 /// 425 Town Plaza Ave, Ponte Vedra, FL 32081

RIDGELINE PRIVATE WEALTH®